Securities Lending: Trading Strategies part II – Index Arbitrage and Convertible Bond Arbitrage

- Roy Zimmerhansl

- May 12, 2020

- 4 min read

From the desk of Jeroen Bakker

Benelux Consulting Lead, Pierpoint Financial Consulting

In my last blog, I wrote about the different strategies of trades conducted on the back of securities lending transactions. I received many positive reactions and equally a lot of requests to explain these trades in even more detail, so in this blog, I will focus on index arbitrage and convertible bond (CB) arbitrage.

These transactions are predominantly traded by investment banks (index arb) and/or hedge funds (CB arb), however more passive asset managers are engaging in index arbitrage as well in order to face off increasing competition and generate higher performance with lower tracking error.

Index arbitrage

This is a strategy that attempts to profit from price differences between two indices or between an index and its composites. This could entail going long the futures contract and short the underlying stock or the other way around. One well-known example of index arbitrage strategies is to attempt to capture the difference between the S&P 500 futures and the published price of the S&P 500 stocks themselves. Theoretically, the price of the S&P 500 should be equal to the full capitalisation weighted calculation of all of the 500 stocks. (That is never quite true because there are costs surrounding buying and holding securities, withholding taxes, etc which don’t apply to an index calculation.) Any difference between the cumulative underlying stocks costs and the futures price provides an opportunity to arbitrage. If the total of the components is cheaper than the price of the future, a buy order for the stocks with the simultaneous sale of an equal amount of futures would generate a risk-free yield.

Let’s create an example index using city names instead of stock names:

Index ABC consists of the following shares, all equally weighted:

● London €20.00 ● Amsterdam €25.00 ● New York €30.00 ● Hong Kong €30.00

with the future trading @ €100.00 and cost to borrow securities of 1% per annum.

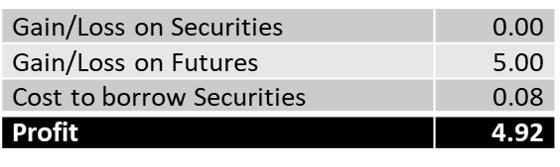

If you buy the future, borrow the underlying securities and sell those in the market you would have an instant €5.00 return and a 100% hedged position. If after one month the future price has gone up to €105.00 while the price of the four shares remained the same you can reverse the trade and the return would look as follows:

It is however important that you maintain a perfect hedge during the duration of the trade. There are a few cases that could jeopardise your hedge and I explain why below.

Rebalancing - All indices are rebalanced on a pre-agreed schedule. The Dow Jones Industrial Average and S&P500, for example, are both rebalanced on a quarterly basis. (Due to the extreme market volatility the rebalance of March 20th was postponed.) If, in our example, Amsterdam falls out of the index and is replaced with Paris on an equal basis then you will need to buy back 1 Amsterdam share (returning it to the securities lender once settled) and borrow one share of Paris to sell in the market.

If you miss this rebalance – the Amsterdam repurchase and Paris sale – it could lead to a significant loss as there is no longer a correlation between these two share prices and the futures contract price.

Of course, this rebalancing example has been oversimplified and hedge fund managers use complicated algorithms to manage their positions, safeguard their hedges and anticipate share price movements ahead of the rebalance. If this rebalance then does not materialise you quickly need to reverse transactions which can result in losses.

Corporate actions - There are many corporate actions such as dividend payments, rights issues, stock splits, mergers etc.

If the Hong Kong share has a stock split of 1 for 2, you need to sell one additional share of Hong Kong (and borrow this from your securities lending agent) to maintain the hedge. Failure to maintain a perfect hedge could lead to significant losses.

Convertible bond arbitrage

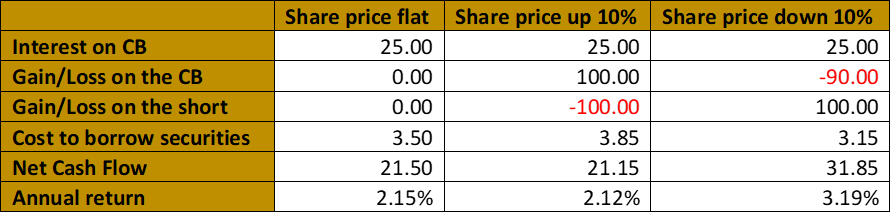

This trading strategy aims to monetise the optionality premium in convertible bonds versus the equity from the same issuer. The trader will buy the bond and sell the underlying equity (by borrowing them) in a close-to-perfect hedge (‘Delta 1’) and at maturity convert the bond to equity and close out the borrow. In a previous blog, we had a simplified example; this week, I will use an example and go into more detail. Just a comment on convertible bond prices – the higher the stock price, the more the bond trades like a stock, the lower the stock price, the more it trades like a bond.

Company ABC issues a convertible bond with the following parameters:

● Maturity 1 year

● Coupon 2.5%

● Share price of ABC €10,00

● Conversion 10 to 1 only at maturity

Remaining parameters

● Purchase €1000 CB

● Interest rate is -/- 0.50%

● SBL fee to cover short 0.35%

● Execute a perfect hedge (delta1)

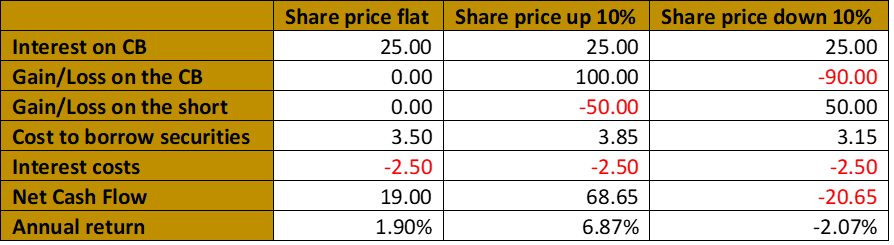

While the above example shows a perfect hedge, the more common variant is to trade this with a 50% delta hedge, giving the following results:

The above example shows, contrary to the general belief that hedge funds only benefit from falling share prices, they also can benefit from rising share prices.

A recent real-life example of convertible bond arbitrage and what in extreme circumstances it can lead to is Asia Research and Capital Management (ARCM) which has a 17% short in the British oil company, Premier Oil. Premier's stock price dropped by as much as 70% in the first four months of the year. This short netted around £135mln; however, ARCM also holds $425mln in convertible bonds in Premier Oil which is 15% of the total net debt of the company.

ARCM and Premier Oil have differences of opinion as to how to reduce the total debt and now find themselves facing each other in court. This is a typical example whereby a straightforward arbitrage can lead to an active share/bondholder trying to influence the strategy of the company.

Conclusion

The trading examples explained are just two of many. Please get in contact with me if you would like other securities lending trading strategies explained. More importantly: as an asset owner participating in any securities lending programme you should have an understanding as to why your stock is borrowed as this has a direct impact on the fee, and therefore the return, you can make.

Still not sure or want to speak to an independent advisor? Book a free call with one of our Pierpoint consultants.

why is the Gain/Loss on CB not -100 but -90 in the example?