Introduction to Financial Markets and the Role of Securities Lending

When: 21 Sep – 24 Sep & 5 Oct - 8 Oct

£248 + VAT

Complete

What you'll learn

Key concepts in financial markets in equities, fixed income, and asset management

The basics of securities lending

More about the demand side that creates the need for the business

Securities finance as a career – who are the stakeholders and what roles exist

The structure of securities lending; participants, stakeholder and relationships

You will really understand how the camera works, so you can use manual settings with confidence

Key features of the risk mitigation through collateralisation

An opportunity for attendees to bring questions in a free format session

Who it’s for:

-

Interns and graduates that would value an explanation of financial markets and introduction to securities finance

-

Anyone in securities finance that could benefit from a course that lays a foundation in markets and bridges the gap to securities lending, explaining both separately but highlighting how they are inextricably linked

-

People that want or need a more comprehensive, yet still introductory level understanding of securities lending

Description

Part One:

Unless people are interested in financial markets personally or study business or finance, they have little exposure to equity and bond markets. Even to these informed individuals, securities lending is a niche component of capital market activity. A better understanding of markets generally and securities lending specifically would help people do their jobs better, but a course that ties the two together builds on the inter-relationship and gives learners a big step up. That’s what this course provides.

Over the 8 hours, attendees will gain a high-level understanding of:

-

What are financial markets and what is their purpose

-

Monetary and fiscal policy

-

Equities, ETFs, ADRs, Indices, IPOs

-

Debt markets and bond fundamentals

-

Derivatives

-

The Asset Lifecycle

-

Active vs Passive investment management

-

Role of Securities Lending in Capital Markets

-

Securities lending revenue creation

-

Risk & Regulation

Building on Part One learning, these extra sessions provide an opportunity for the information to be applied at work

The additional 4 hours will provide attendees with further understanding of:

-

Overview of hedge fund strategies, short selling (including MEME stocks) and process flows

-

Collateral choices, alternatives, risks and mitigants

-

The Post-Trade management process

-

Jobs, careers and locations in securities finance

Format

21-24 Sep:

8 x 1 hour webinar sessions, with 50 minutes of lecture followed by 10 minutes of Q&A

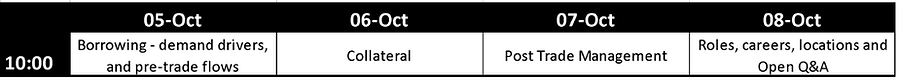

5-8 Oct:

4 x 1 hour webinar sessions, with 50 minutes of lecture followed by 10 minutes of Q&A

Schedule